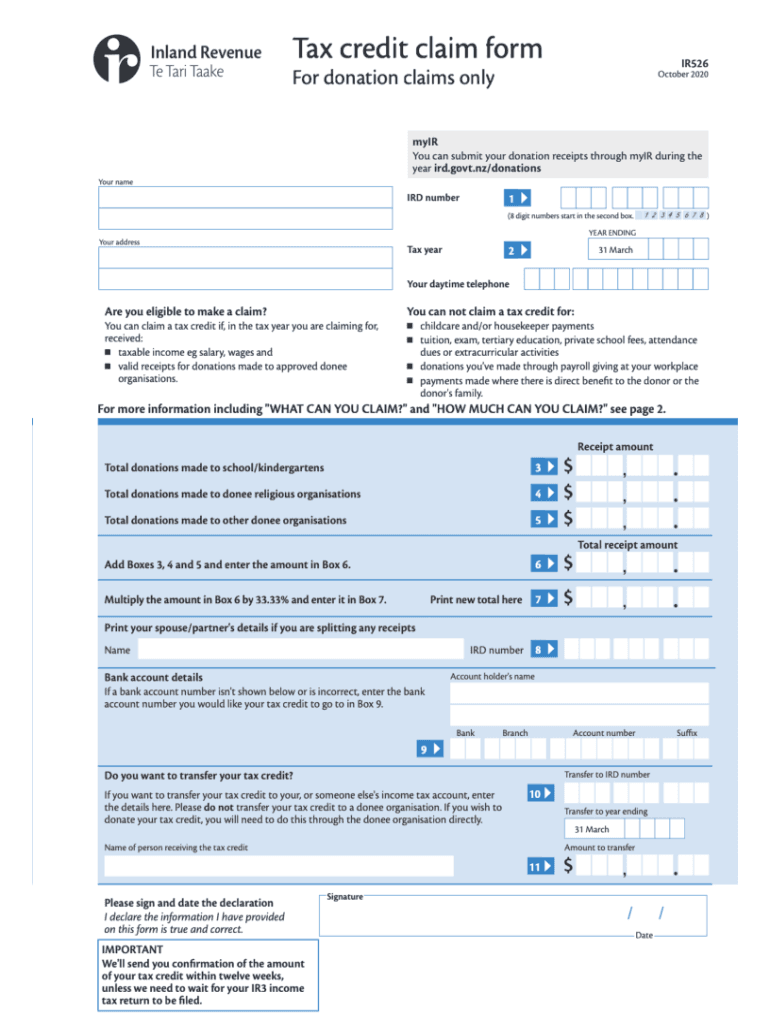

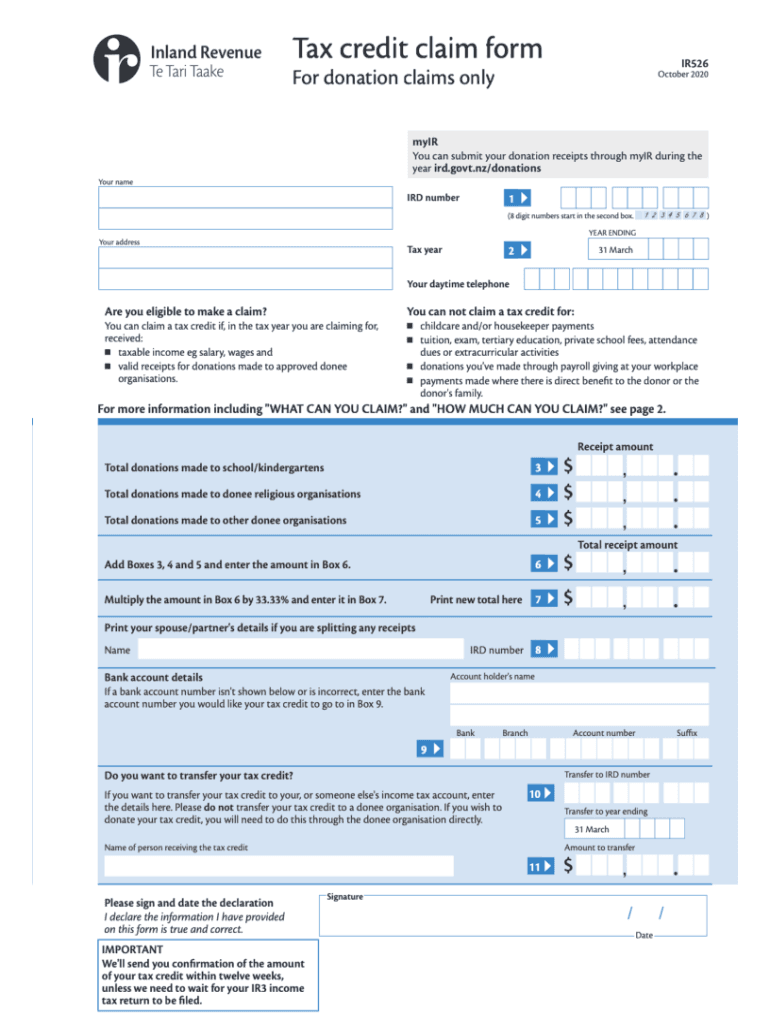

NZ IR 526 2020-2024 free printable template

Get, Create, Make and Sign

How to edit ir526 online

NZ IR 526 Form Versions

How to fill out ir526 2020-2024 form

How to fill out ir526:

Who needs ir526:

Video instructions and help with filling out and completing ir526

Instructions and Help about tax credit form 526

Hey guys its Sean from tested we aback today with a review of the form labs form 3 it's their newest SL a resin printer, and we've been using it for about two months this is a prettyin-depth long-term kind of review Before we jump into it, I think we should review SLA printing just for those of you who may not know you have FDM printing chichis the plastic filament printing you typically see around home and school sand is probably the most common 3d printing that pops up have a spool of plastic filament that gets extruded through a hot nozzle and drawn onto the print bed SLA or stereo lithography printing works a little different it ISA liquid resin which is getting cured and hardened by a UV light so in this case a laser which is the same as their previous form — and form one plus having said that once you're done with the print you typically have to wash it in alcohol to get off the extra resin sometimes there's a little post curing that you have to do with a UV light or out in the Sun depending on the resin and the print process itself generally is a platform that goes down into liquid vat of resin a laser or other UV light hits it through an optically clear tray bottom hardens it there's usually a peel process which breaks it loose from the bottom of the tank so in the case of the form — it would slide to the side break it looses lift the resin flows back in, and it repeats that until you'real done so what they've done with the form 3 is kind of a drastic departure from how SLA has been done before they're calling it low for stereo lithography and that involves two mechanisms which are different from the two the first is a tray the resin tray has a flexible bottom and combined with that is a light processing unit the CPU which actually moves the laser back and forth across the bottom of the tray, so it will tent up the bottom of that flexible tray and basically as it moves past the printed part it is doing a bit of a peel process as it goes, so it doesn't move the afterwards that it is raises it up to let the resin flow back in, and it continues that until it's done what that allows the printer to do is it puts fearless strain on the print and the print supports, so you know when you have these suspended from the tray there's usually some kind of support mechanism which holds the print itself so the low force carrier lithography allows you to get finer surface finish and use less supports or finer point tips which will break off easier or a combination of the both and in practice it definitely worked I got really, really nice prints out of it, and we'll go in a little more how the mechanism on this particular unit works after we talk about the rest of the specs they've also lowered the laser spot size it is an 85 micron laser spot versus the 140 micron spot size that was on the forum — so theory should be able to get finer detail resolved with that laser the wattage has remained the same between the two it can handle and print layer Heights...

Fill tax credit claim form : Try Risk Free

People Also Ask about ir526

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ir526 2020-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.