NZ IR 526 2020-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

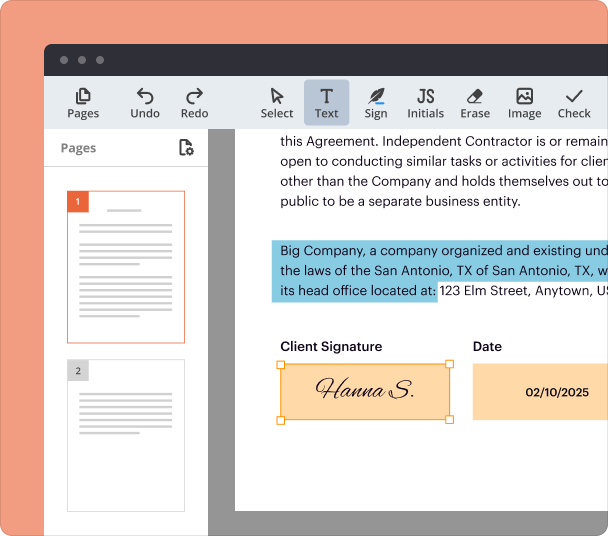

Edit and sign in one place

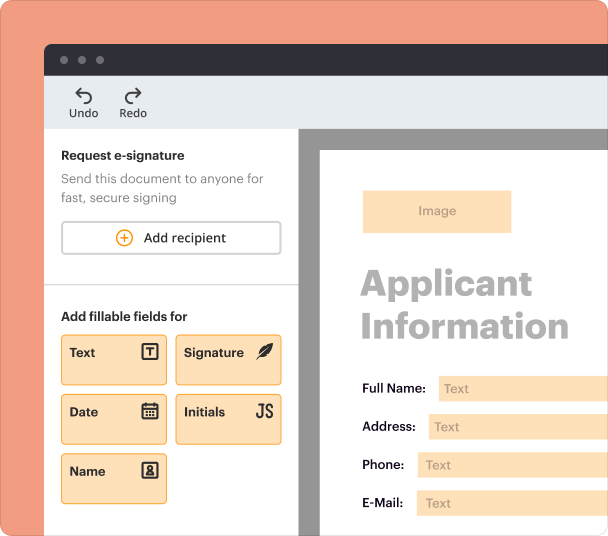

Create professional forms

Simplify data collection

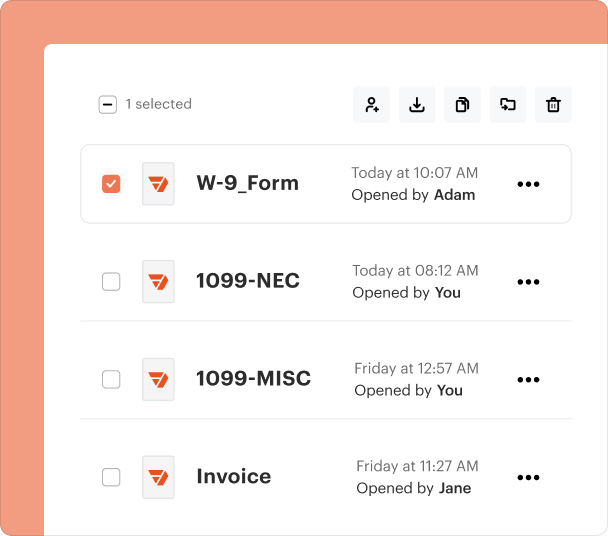

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

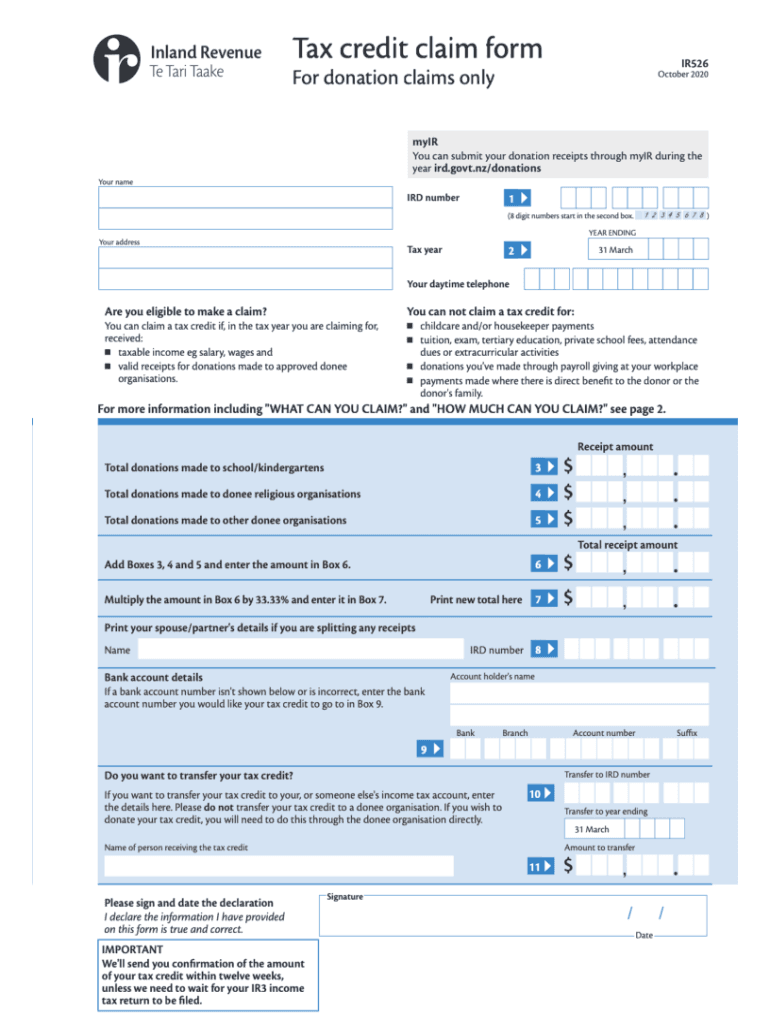

Comprehensive Guide to the NZ IR-2025 Form

Understanding the NZ IR-2025 Form

The NZ IR-2025 form is a tax document utilized for claiming tax credits related to donations made during the specified tax years. This form allows taxpayers to report their charitable contributions and facilitates the calculation of any eligible tax credits that may arise from such donations.

Key Features of the NZ IR 526 Form

This form boasts several important features that streamline the process of claiming tax credits. It includes detailed sections for entering information about donated amounts, recipient charities, and specific eligibility requirements. Notably, the form also provides calculations for determining tax credits, reducing the effort required for users to find this information independently.

When to Utilize the NZ IR 526 Form

The NZ IR 526 form should be used whenever an individual or entity has made donations to registered charities during the tax years 2020 to 2025. It is essential for those wishing to maximize their tax benefits related to charitable giving, ensuring appropriate documentation is submitted to support their claims.

Who Should Complete the NZ IR 526 Form?

Any individual taxpayer or business entity that has made qualifying donations throughout the tax period should complete the NZ IR 526 form. This includes corporations, partnerships, and sole proprietors, all of whom may wish to take advantage of the tax credits available for charitable contributions.

How to Accurately Fill Out the NZ IR 526 Form

To correctly complete the NZ IR 526 form, users should gather necessary documentation, such as receipts from charities and records of total donations. It's important to fill in the form accurately, paying close attention to the required sections. This will involve providing details about the donation amounts, the recipient charities, and ensuring that calculations are made as per the guidelines laid out in the form.

Best Practices for Completing the NZ IR 526 Form

When completing the NZ IR 526 form, users should maintain organized records of all donations, double-check entries for accuracy, and ensure that the form is submitted by the deadline. Familiarizing oneself with the form's structure and guidelines can reduce errors and facilitate a smoother filing process.

Common Errors When Filing the NZ IR 526 Form

Some frequent mistakes made when filing the NZ IR 526 form include incorrect amounts listed for donations, failing to include all required receipts, and submitting the form after the deadline. Recognizing these potential pitfalls can help taxpayers avoid issues with their claims.

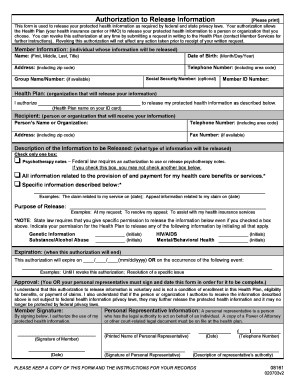

Frequently Asked Questions about ird donations claim form

What should I include as proof of donation?

You should include official receipts from the charitable organizations to verify your donations, as well as any relevant bank statements if applicable.

Is there a deadline for submitting the NZ IR 526 form?

Yes, the NZ IR 526 form must typically be submitted by the tax filing deadline for the respective years, which usually follows the April 15 guideline for individual taxpayers.

pdfFiller scores top ratings on review platforms